The cost of homeowner’s insurance rates in Florida can vary depending on several factors:

1) the home’s proximity to the coast

2) the method of construction

3) the type of roof

4) the homeowner’s coverage options

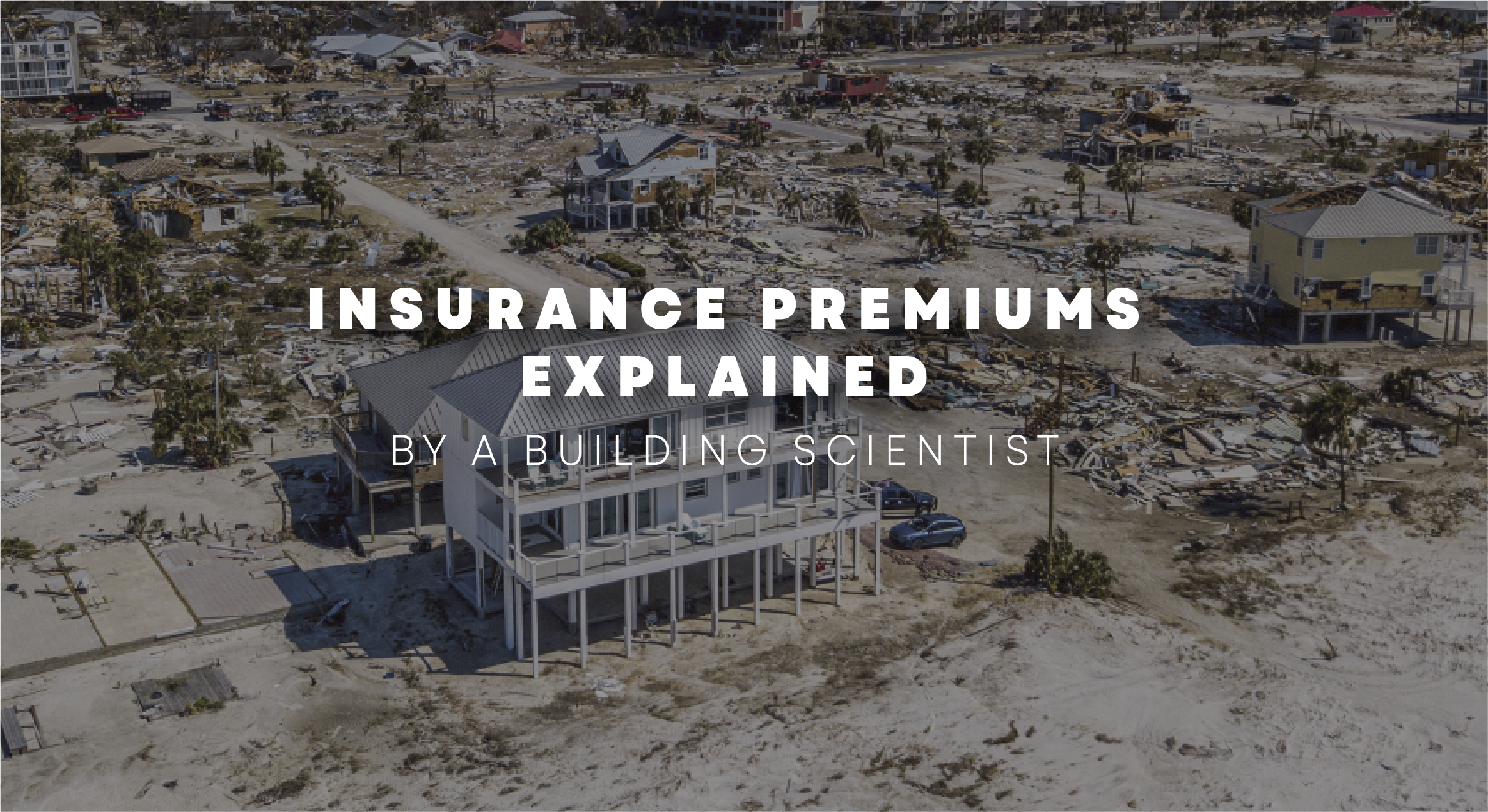

Florida is known for its high risk of natural disasters such as hurricanes and floods, which can result in higher insurance rates. The cost of home insurance in Florida also varies by county and zip code, with areas prone to higher risk experiencing higher rates. According to a report by the National Association of Insurance Commissioners, the average cost of homeowners insurance in Florida in 2018 was $1,918 per year, which is higher than the national average of $1,211. In Florida’s coastal areas, insurance providers have dropped coverage for some policy holders, while other policy holders have seen their insurance premiums triple in cost. Coastal areas in Florida, particularly those in high-risk flood zones, have seen a significant increase in insurance premiums and a reduction in coverage availability. This is due to several factors, including the high risk of hurricanes and floods, rising sea levels, and increased property values.

Insurance providers are in the business of assessing and managing risk, and the risk associated with coastal properties in Florida has increased significantly in recent years. As a result, insurance providers have become more selective in the areas they cover and have increased premiums to reflect the higher risk. In some cases, insurance providers have completely stopped offering coverage for coastal properties in high-risk areas.

Homeowners in these areas are left with fewer options and are often forced to purchase insurance from state-run programs that can be more expensive and offer less coverage. The situation has become a concern for many homeowners and policymakers in Florida, as insurance affordability and availability are critical for the state’s coastal communities. To address this issue, the state has implemented several programs to encourage insurance providers to continue offering coverage in high-risk areas, including grants for hardening homes against natural disasters and funding for insurance providers to mitigate risk. Insurance companies are starting to offer savings for more durable methods of construction such as concrete. This fortified method of construction can help protect both the building and its occupants during a hurricane or other extreme weather events. In addition, concrete structures are less likely to suffer damage from water infiltration, which can help prevent structural damage and mold growth.

Concrete structures are considered more durable and resistant to natural disasters such as hurricanes, which can make them more attractive to insurance providers. Insurance providers also recognize the added protection that concrete construction can provide against high winds, flooding, and fire, which are common risks in Florida.

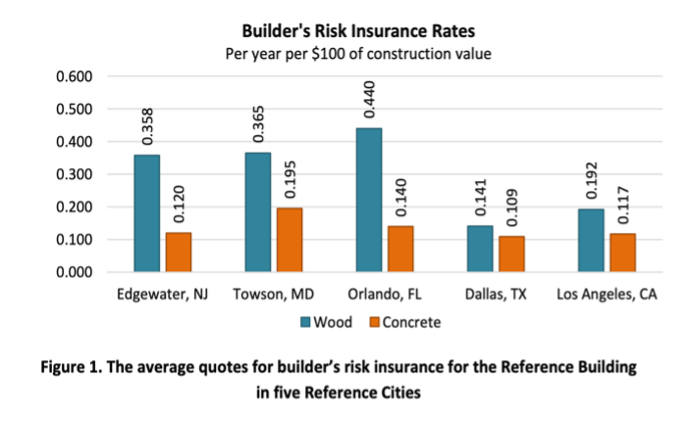

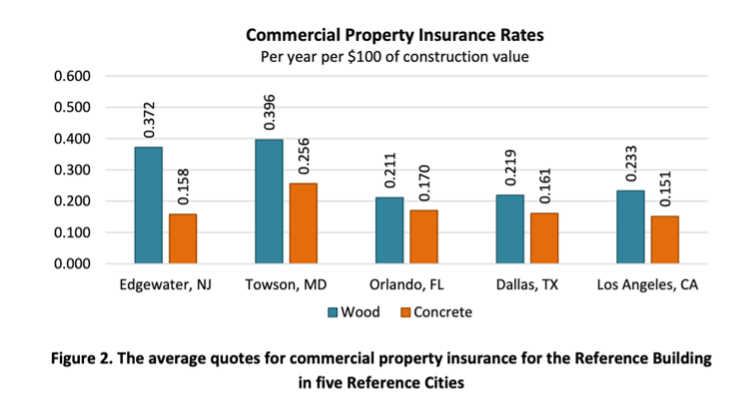

Can concrete construction save you money? According to the “Survey of Insurance Costs for Multifamily Buildings Constructed with Wood‐frame and Concrete” (VanderWerf, 2017), a developer can save between 22-72% on their builder’s risk premium and between 14-65% on their commercial property insurance when they build with concrete [1].

Hurricane Resistance: Concrete is a durable and sturdy material that can withstand high winds and storms. In Florida, where hurricanes are common, concrete construction provides added protection to homes and buildings, making them more hurricane-resistant.

Fire Resistance: Concrete is a non-combustible material, making it an ideal choice for construction in areas prone to wildfires. Concrete structures have a higher fire rating than wood structures and can better withstand the heat of a fire.

Energy Efficiency: Concrete construction is known for its excellent thermal mass properties, meaning it can regulate indoor temperatures, reducing the need for heating and cooling systems. This can lead to lower energy bills for homeowners and businesses.

Mold and Mildew Resistance: Florida’s warm and humid climate makes it a breeding ground for mold and mildew. Concrete structures are less susceptible to mold and mildew growth, reducing the risk of health hazards and maintenance costs associated with mold remediation.

Durability/Sustainability: Concrete is a sustainable material that is produced locally, reducing transportation costs and emissions associated with importing materials from other regions. Furthermore, a concrete home is a fortified home able to withstand the extreme weather events, is less likely to suffer damage from natural disasters, and increases the peace of mind for its occupants.

Low Operational Cost: Concrete homes reduce the maintenance burden, have lower utility costs, and can reduce the insurer’s risk, resulting in a lower insurance premium for the owner.

Overall, concrete construction offers several advantages in Florida due to its strength, durability, and ability to withstand the state’s unique environmental conditions. It is also a cost-effective and resilient alternative to traditional construction.

To learn more about fortified buildings, visit https://concrewallusa.com/process/.

About the Author: Dave Robau is Building Scientist and LEED practitioner with over 20 years of professional experience. He is a subject matter expert on fortified construction and clean energy issues and lectures widely on related topics. He currently serves as a consultant with Concrewall USA.

[1] Survey of Insurance Costs for Multifamily Buildings Constructed with Wood‐frame and Concrete. Dr. Pieter VanderWerf and Nicholas Haidari, Boston College, October 2017

Join our FREE WEbinar

Are you ready to revolutionize your building projects?

Join us for an exclusive webinar where we’ll introduce you to the innovative SCIP construction system. Discover how Concrewall USA can help you deliver superior results for your clients and stand out in the competitive construction industry.